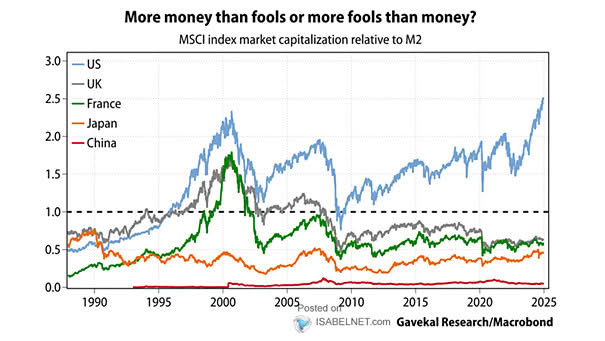

Valuation – Market Capitalization of Stock Market / M2 Money Supply

Valuation – Market Capitalization of Stock Market / M2 Money Supply The current high market capitalization of U.S. equities relative to M2 suggests that investors are anticipating very optimistic future earnings and a stable economic outlook. Image: Gavekal, Macrobond