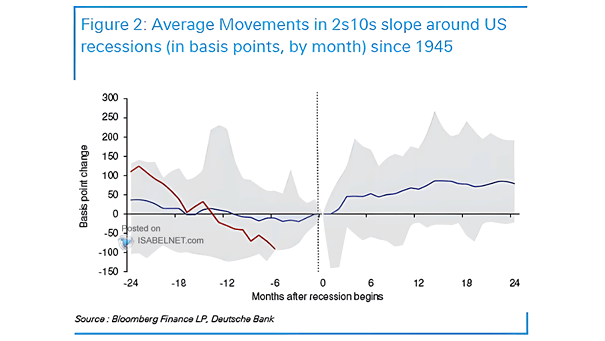

Average Movements in 2s10s Slope Around U.S. Recessions

Average Movements in 2s10s Slope Around U.S. Recessions Historically, when the U.S. 2s10s yield curve has been inverted by more than -100bps, a U.S. recession is currently happening or will happen within 8 months. Is it different this time? Image: Deutsche Bank