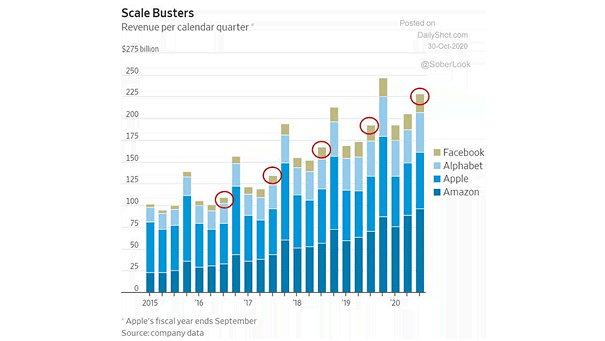

Hyperscaler Capex by Company

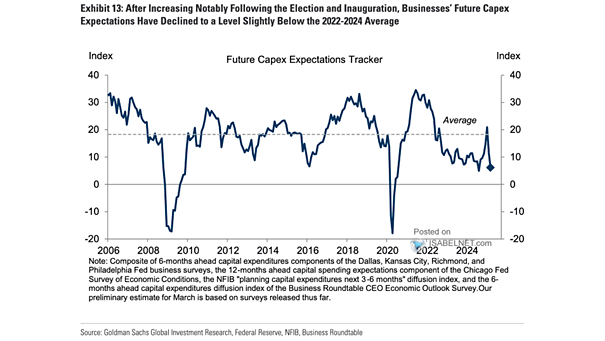

Hyperscaler Capex by Company A once-in-a-generation AI-driven capex boom is reshaping the industry. Hyperscalers are spearheading this change with massive investments in AI infrastructure, with spending set to reach $330 billion in 2025. Image: Goldman Sachs Global Investment Research