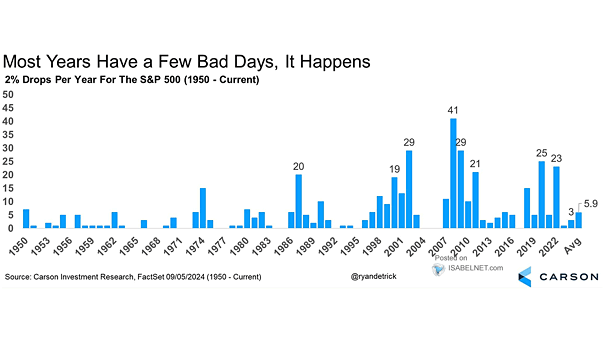

Number of 2% Drops per Year for the S&P 500 Index

Number of 2% Drops per Year for the S&P 500 Index Though they can be uncomfortable, big drops in the U.S. stock market are relatively common, even in the best years. On average, the S&P 500 sees more than five drops of 2% or more each year. Image: Carson Investment Research