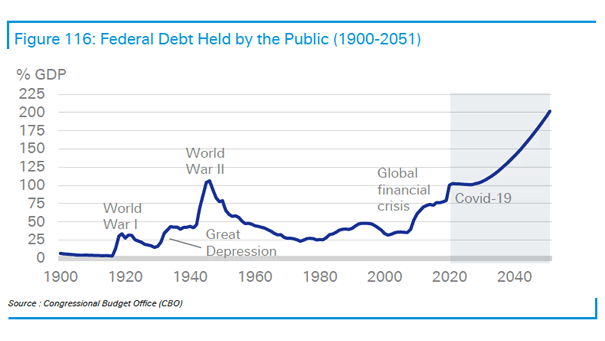

U.S. Federal Debt Held by the Public

U.S. Federal Debt Held by the Public The U.S. public debt has reached unprecedented levels both in absolute terms and relative to the economy, raising significant concerns about the country’s fiscal sustainability and economic future. Image: Deutsche Bank