Passive vs. Active Investing – Single Stocks vs. Equity ETFs

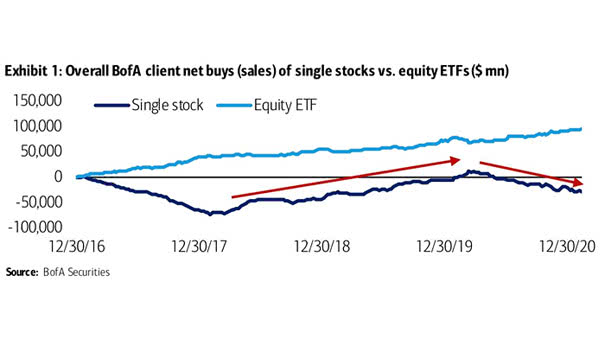

Passive vs. Active Investing – Single Stocks vs. Equity ETFs More passive investing amid COVID, as BofA clients have bought ETFs almost 90% of the time over the last 50 weeks. Image: BofA Securities