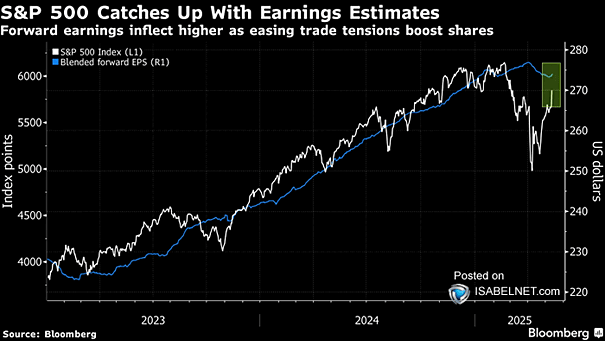

S&P 500 Index and Blended Forward EPS

S&P 500 Index and Blended Forward EPS The recent easing of tariffs has helped reverse the persistent negative earnings trend in U.S. equities, leading to a strong market rebound and improved short-term sentiment. Image: Bloomberg