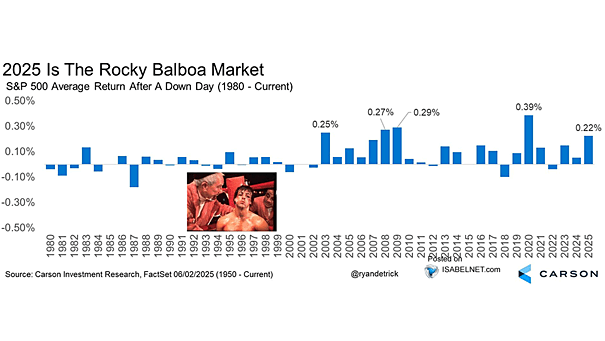

S&P 500 Average Return After a Down Day

S&P 500 Average Return After a Down Day The year 2025 stands out for the S&P 500, especially because of its resilience following daily declines. Since January, it has rebounded by an average of 0.32% the day after a drop, underscoring its strong ability to recover quickly. Image: Carson Investment Research