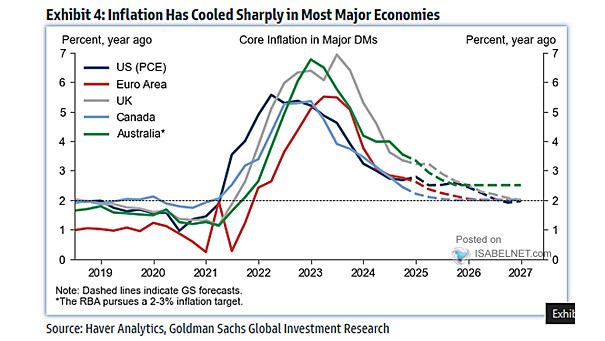

Developed Market Core Inflation Rates

Developed Market Core Inflation Rates In most major economies, inflation rates have significantly eased. While challenges remain, current trends suggest that inflationary pressures are gradually coming under control. Image: Goldman Sachs Global Investment Research