Earnings – S&P 500 Consensus EPS Revision

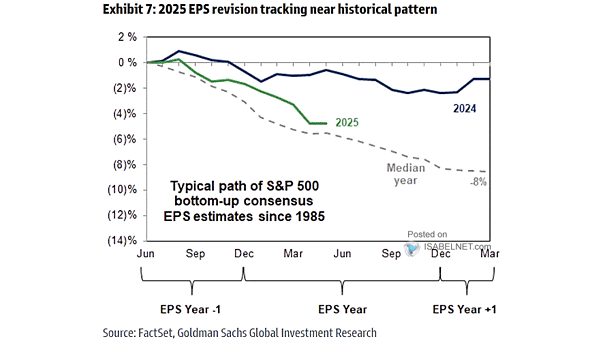

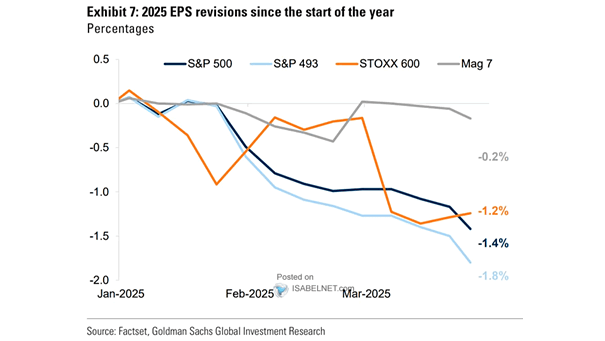

Earnings – S&P 500 Consensus EPS Revision The 2025 EPS revision trend follows historical patterns. With high initial estimates and ongoing macroeconomic uncertainty, investors should stay alert for possible further downward adjustments. Image: Goldman Sachs Global Investment Research