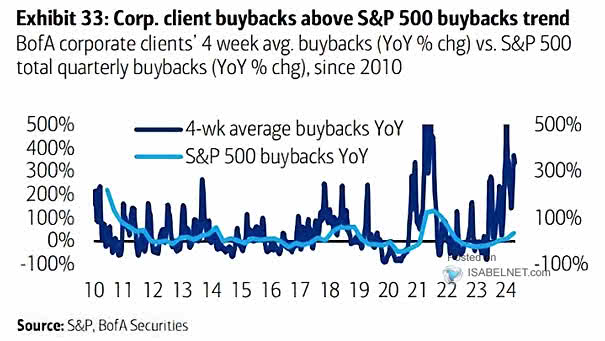

Corporate Clients’ 4-Week Average Buybacks vs. S&P 500 Total Quarterly Buybacks

Corporate Clients’ 4-Week Average Buybacks vs. S&P 500 Total Quarterly Buybacks BofA’s corporate clients have been accelerating their stock buyback activity, surpassing the overall trend of S&P 500 buybacks. This defies recession fears and reflects confidence in companies’ future growth potential. Image: BofA Securities