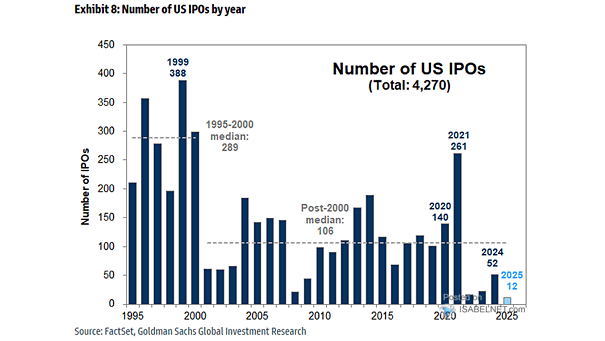

Tech IPOs vs. Non-Tech IPOs

Tech IPOs vs. Non-Tech IPOs Tech IPO shares have soared an average of 108% above their offering price. By comparison, non-tech IPOs have gained 49%, a solid return but significantly less than the surge seen in tech offerings. Image: Yahoo Finance