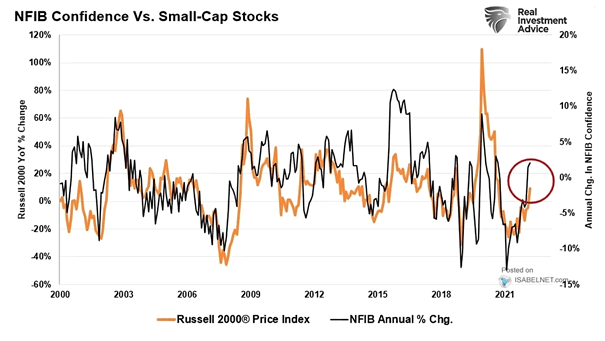

NFIB Confidence vs. U.S. Small-Cap Stocks

NFIB Confidence vs. U.S. Small-Cap Stocks The annual rate of change in the NFIB Small Business Survey is closely correlated with the performance of U.S. small-cap stocks, making the NFIB index a valuable economic indicator for investors in this market segment. Image: Real Investment Advice