S&P 500 Risk-Adjusted Returns

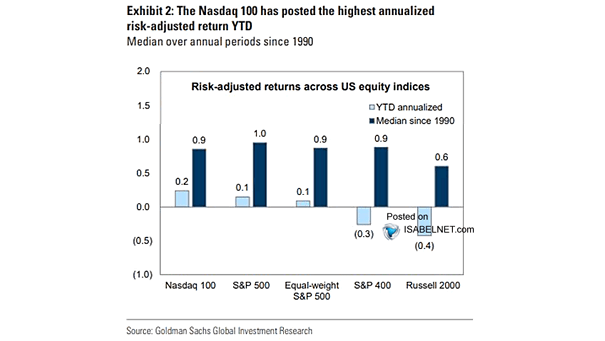

S&P 500 Risk-Adjusted Returns The S&P 500’s risk-adjusted return in 2025 has been disappointing so far, reflecting a challenging market environment characterized by increased volatility and lower-than-average returns. Image: Goldman Sachs Global Investment Research