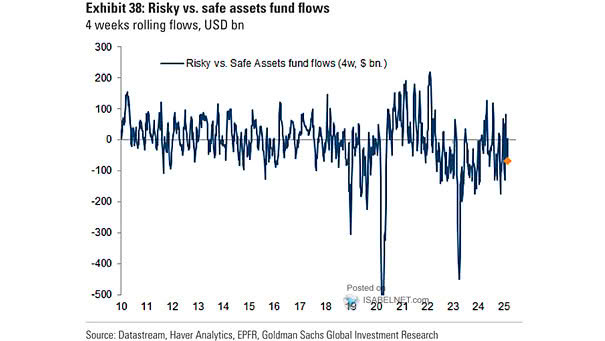

Risky vs. Safe Assets Fund Flows

Risky vs. Safe Assets Fund Flows The ongoing preference for safe assets over risky ones indicates investor wariness about market conditions and a focus on capital preservation in uncertain times. Image: Goldman Sachs Global Investment Research