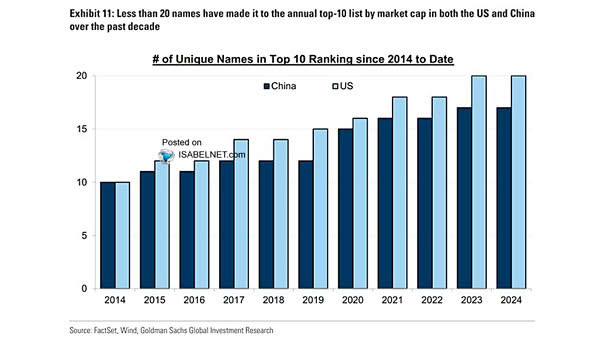

Number of Unique Names in Top 10 Ranking Since 2014 to Date

Number of Unique Names in Top 10 Ranking Since 2014 to Date Over the past decade, less than 20 companies have consistently ranked among the top 10 by market capitalization in both the U.S. and China. This reflects the dominance of a small group of large firms within each market. Image: Goldman Sachs Global Investment…