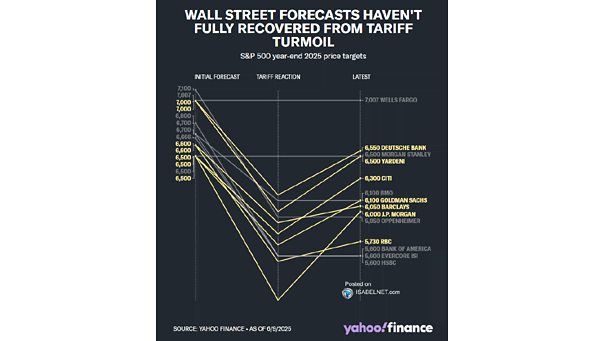

Average Strategist Year-End S&P 500 Forecast

Average Strategist Year-End S&P 500 Forecast Despite trade-related uncertainties, Wall Street’s leading firms remain confident in the S&P 500’s further gains through 2025, driven by strong corporate earnings, operational resilience, and accommodative monetary policy prospects. Image: Bloomberg