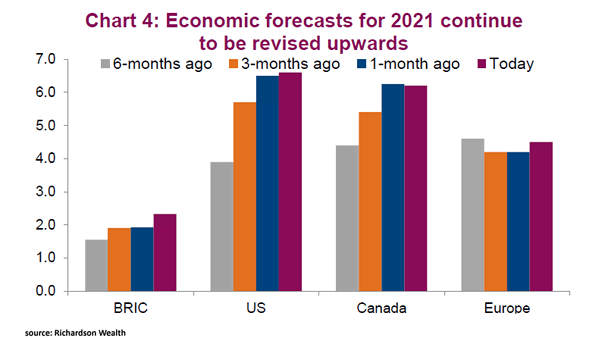

Economic Forecasts

U.S. Economic Forecasts Deutsche Bank’s baseline forecast depicts a U.S. economy maintaining robust growth, with inflation gradually approaching the Fed’s 2% target and unemployment declining by the end of 2026. Image: Deutsche Bank