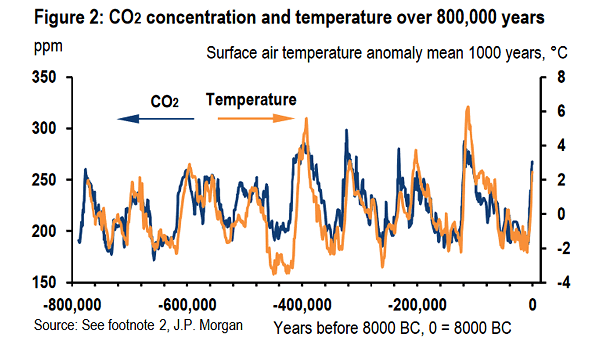

Climate – CO2 Concentration and Temperature over 800,000 Years

Climate – CO2 Concentration and Temperature over 800,000 Years This interesting chart shows the correlation between CO2 concentration and temperature over 800,000 years. Image: J.P. Morgan