The Link To Oil

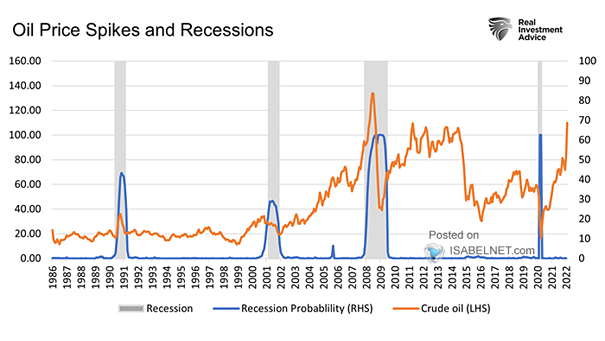

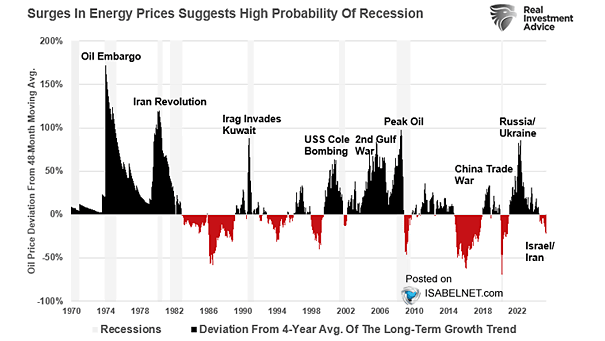

The Link To Oil Oil consumption is deeply embedded in nearly every facet of modern life, from the food we eat to the products and services we purchase. This widespread use makes oil demand a strong indicator of economic strength or weakness. Image: Real Investment Advice