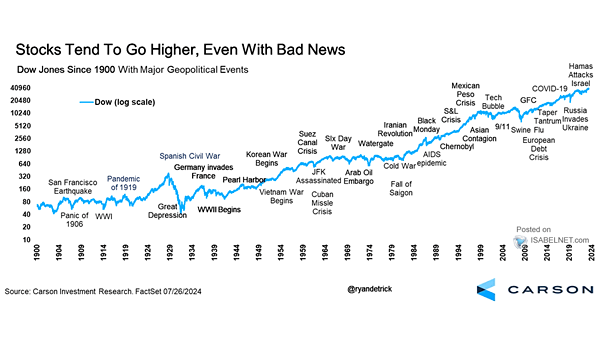

Stocks – Dow Jones with Major Geopolitical Events

Stocks – Dow Jones with Major Geopolitical Events While geopolitical events can cause short-term market volatility, historical evidence shows that U.S. stocks tend to recover and grow over the long term. Image: Carson Investment Research