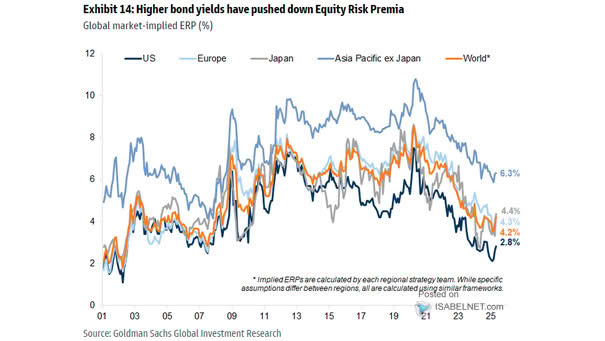

Global Market Implied Equity Risk Premiums

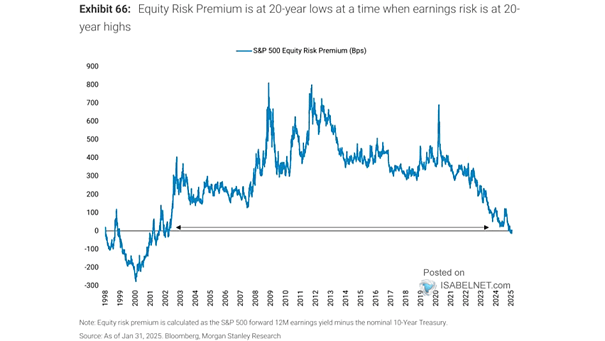

Global Market Implied Equity Risk Premiums The low U.S. equity risk premium reflects a market where investors earn little to no additional expected return for taking on the higher risk of stocks compared to bonds. As a result, equity investing becomes more challenging. Image: Goldman Sachs Global Investment Research