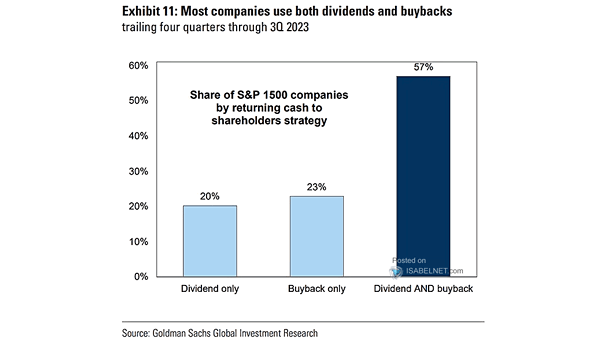

Share of S&P 1500 Companies by Returning Cash to Shareholders Strategy

Share of S&P 1500 Companies by Returning Cash to Shareholders Strategy Most S&P 1500 companies are returning cash to shareholders through both dividends and buybacks, which can significantly boost shareholder returns. Image: Goldman Sachs Global Investment Research