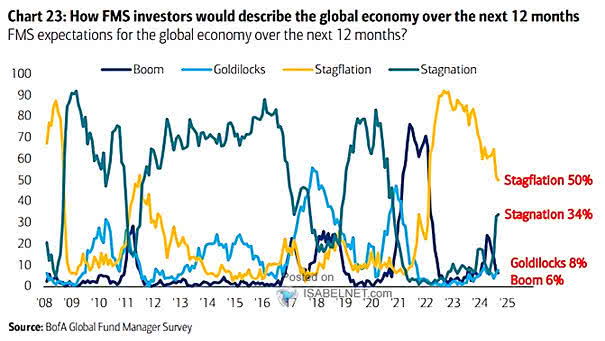

How FMS Investors Believe the Global Economy Trends Will Be in Next 12 Months

How FMS Investors Believe the Global Economy Trends Will Be in Next 12 Months 50% of FMS investors expect stagflation in the global economy over the next 12 months, marked by stagnant growth and high inflation, while 34% foresee stagnation, leading to a cautious investment approach. Image: BofA Global Fund Manager Survey