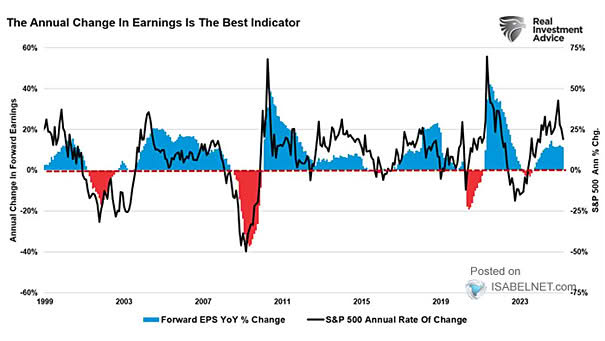

S&P 500 Annual Rate of Change vs. Annual Change in GAAP Earnings

Forward EPS YoY % Change vs. S&P 500 Annual Rate of Change Corporate earnings play a key role in shaping market performance. In 2025, the expected U.S. economic slowdown might limit their growth, challenging stock…