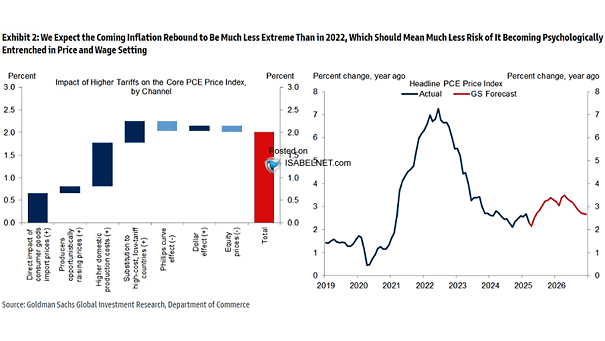

Impact of Higher Tariffs on the U.S. Core PCE Price Index

Impact of Higher Tariffs on the U.S. Core PCE Price Index The coming inflation rebound is expected be limited in scope and duration, meaning it is unlikely to trigger the kind of persistent inflation psychology that can drive a sustained wage-price spiral. Image: Goldman Sachs Global Investment Research