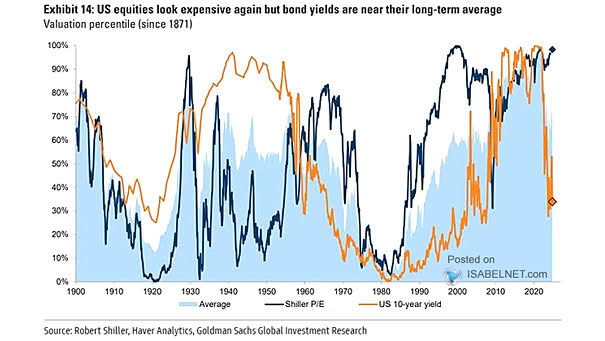

Valuation – Shiller P/E and U.S. 10-Year Yield

Valuation – Shiller P/E and U.S. 10-Year Yield While U.S. equities appear expensive, bond yields are aligning more closely with their long-term averages, providing potential opportunities for investors. Image: Goldman Sachs Global Investment Research