Earnings Growth – Mag 7 and S&P 500 ex-Mag 7

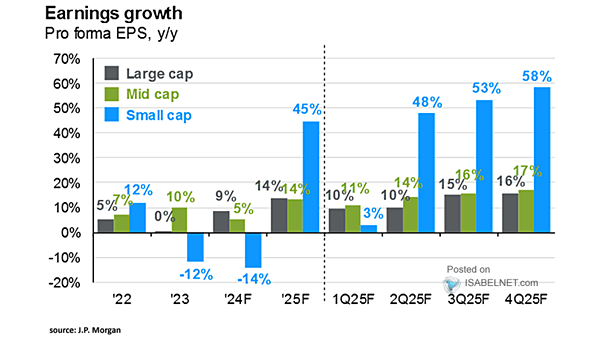

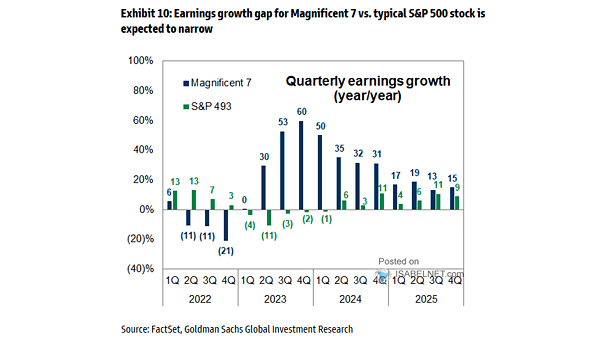

Earnings Growth – Mag 7 and S&P 500 ex-Mag 7 While the pace of earnings growth for the Magnificent Seven is expected to moderate from the explosive gains of recent years, they are still forecast to outperform the rest of the S&P 500 throughout 2025 and 2026. Image: J.P. Morgan Asset Management