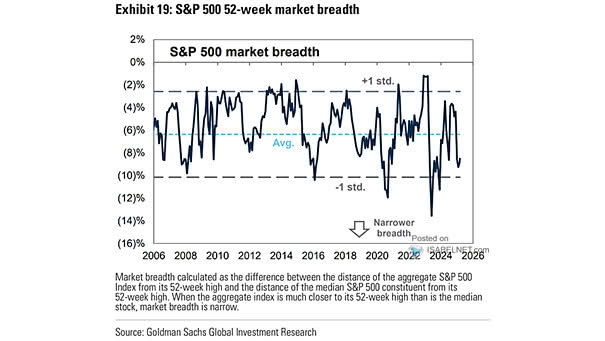

Market Breadth – Percent Below 52-Week High S&P 500 Index Less Median Stock

Market Breadth – Percent Below 52-Week High S&P 500 Index Less Median Stock In recent months, the S&P 500’s 52-week market breadth has shown signs of deterioration. Is an improvement possible before the end of the year? Image: Goldman Sachs Global Investment Research