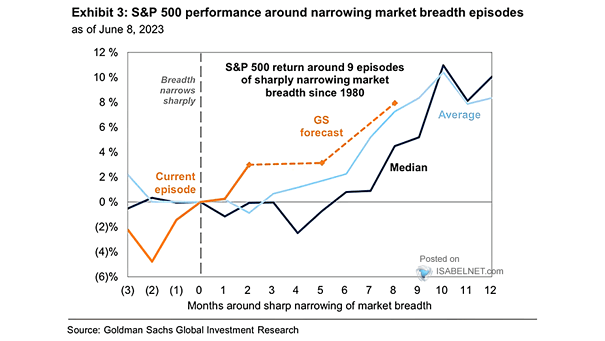

S&P 500 Performance Around Narrowing Market Breadth Episodes

S&P 500 Performance Around Narrowing Market Breadth Episodes A sharp narrowing market breadth does not necessarily indicate a negative return for the S&P 500 over the next 12 months. Image: Goldman Sachs Global Investment Research