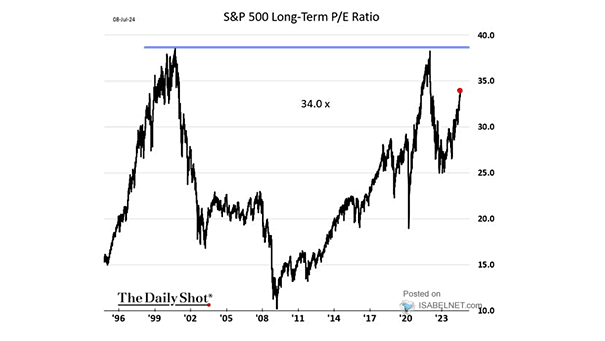

Valuation – S&P 500 Long-Term P/E Ratio

Valuation – S&P 500 Long-Term P/E Ratio Valuation, particularly in the context of the S&P 500’s long-term P/E ratio, is a significant consideration for investors. The high current ratio suggests potential overvaluation. Image: The Daily Shot