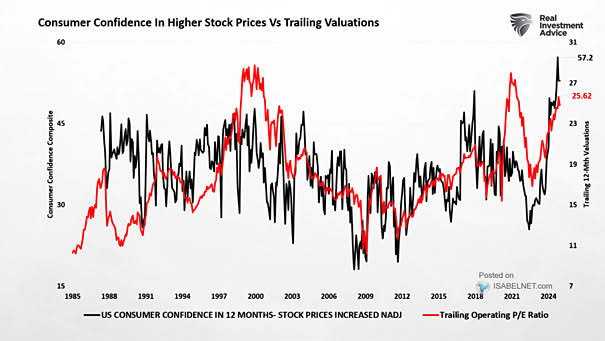

U.S. Consumer Confidence Composite vs. Trailing S&P 500 Valuations

U.S. Consumer Confidence Composite vs. Trailing S&P 500 Valuations The composite consumer confidence index is highly correlated with trailing one-year S&P 500 valuations, which can signal times of market exuberance or caution. Image: Real Investment Advice