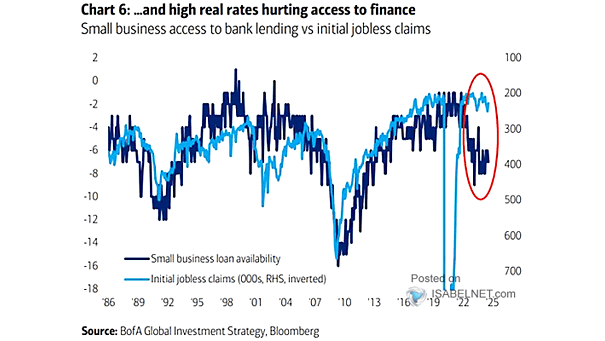

NFIB Small Business Availability Loans vs. U.S. Initial Jobless Claims

NFIB Small Business Availability Loans vs. U.S. Initial Jobless Claims When interest rates are high, weak credit conditions can greatly affect the economy, potentially resulting in increased unemployment. Image: BofA Global Investment Strategy