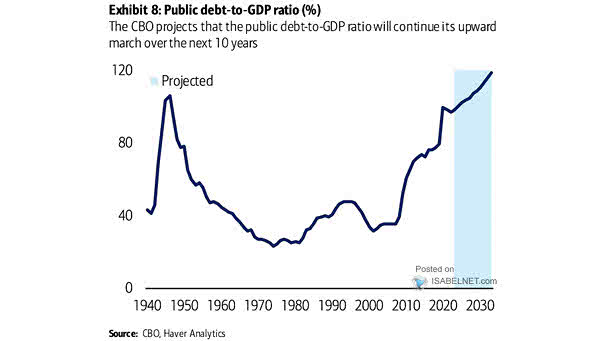

U.S. Debt Held by Public as Share of GDP

U.S. Debt Held by Public as Share of GDP Rising U.S. federal debt could lead to higher interest payments, reduced investment and growth, fewer jobs, lower wages, and less flexibility for the government to respond to future challenges. Image: Goldman Sachs Global Investment Research