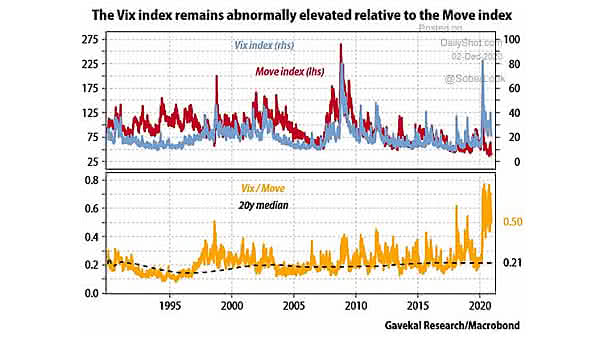

Volatility Divergence – VIX vs. MOVE

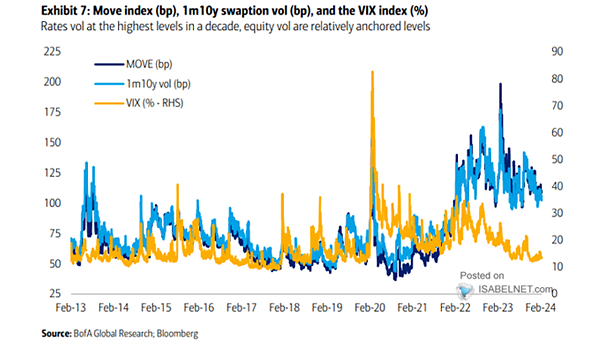

Volatility Divergence – VIX vs. MOVE The divergence between VIX and MOVE presents unique challenges and opportunities for market participants, reflecting different expectations and perceptions of risk in the equity and bond markets. Image: BofA Global Research