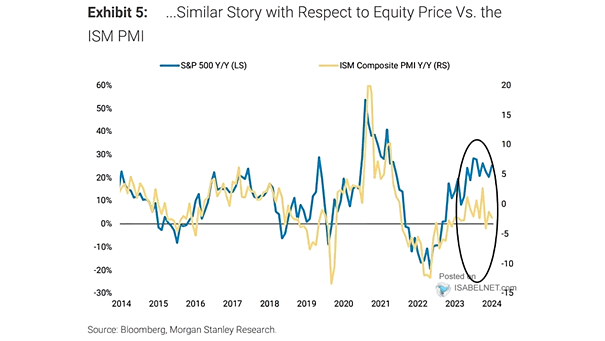

S&P 500 vs. ISM Composite PMI

S&P 500 vs. ISM Composite PMI The divergence between the U.S. ISM Composite PMI and the S&P 500 has become increasingly notable, reflecting contrasting signals about the health of the U.S. economy. Image: Morgan Stanley Research