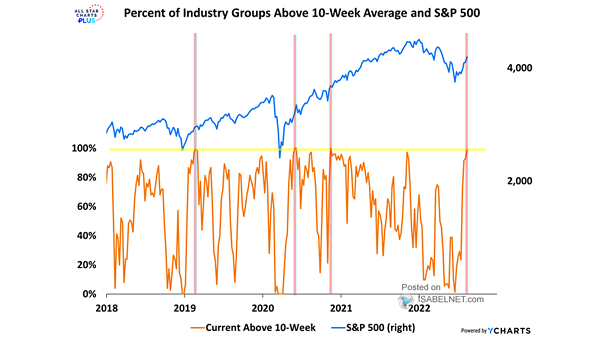

Percent of Industry Groups Above 10-Week Average and S&P 500

Percent of Industry Groups Above 10-Week Average and S&P 500 Is the current rally in U.S. equities more than just a bear market bounce, as 99% of industry groups are above their 10-week average? Image: All Star Charts