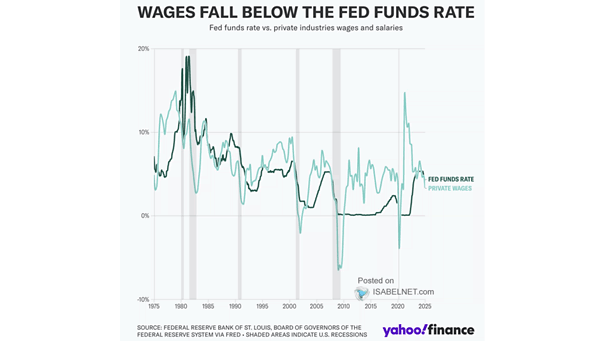

Wage Growth vs. Fed Funds Rate

Wage Growth vs. Fed Funds Rate When wage growth lags behind the fed funds rate, it is interpreted as a sign that monetary policy is restrictive, as borrowing costs exceed the pace of income growth, potentially dampening consumer spending and economic activity. Image: Yahoo Finance