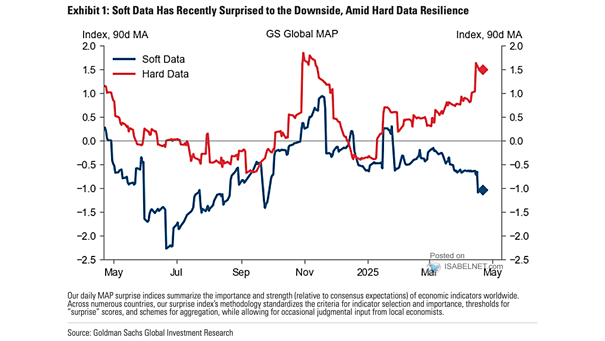

Hard Data vs. Soft Data

Hard Data vs. Soft Data The notable divergence between soft and hard economic data highlights the challenge of interpreting the true state of the economy. While sentiment surveys suggest caution, hard data has yet to confirm a significant slowdown. Image: Goldman Sachs Global Investment Research