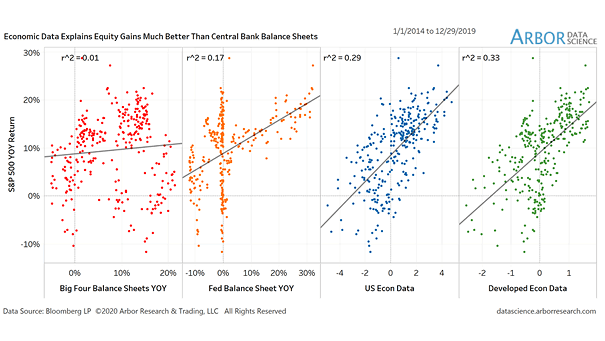

S&P 500 Return vs. Economic Data and Central Bank Balance Sheets

S&P 500 Return vs. Economic Data and Central Bank Balance Sheets Charts suggesting that economic data drives S&P 500 returns, not central bank balance sheets. Image: Arbor Research & Trading LLC