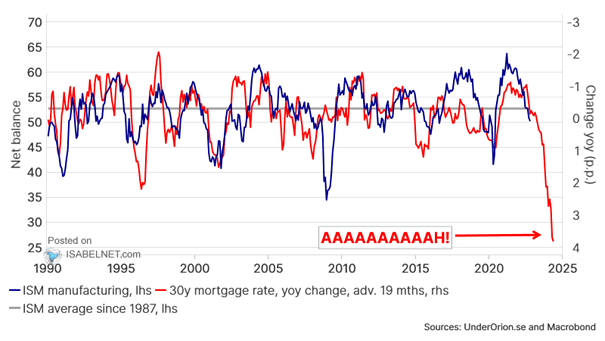

U.S. ISM Manufacturing Index vs. U.S. 30-Year Mortgage Rate YoY Change

U.S. ISM Manufacturing Index vs. U.S. 30-Year Mortgage Rate YoY Change The U.S. 30-year mortgage rate YoY change tends to lead the U.S. ISM Manufacturing Index by 19 months. Image: UnderOrion and Macrobond