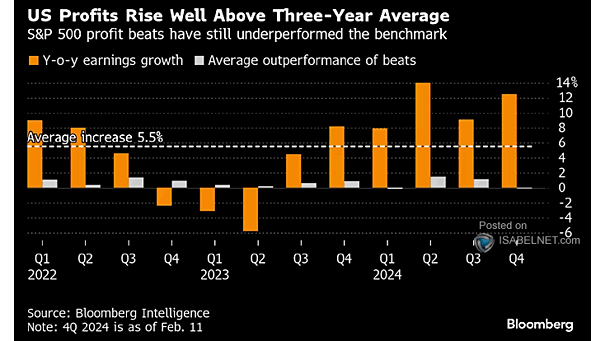

YoY Earnings Growth and Average Outperformance of Beats

YoY Earnings Growth and Average Outperformance of Beats Despite strong U.S. corporate performance in the current earnings season, investor enthusiasm and market reactions are tempered by underlying concerns about tariffs, interest rates, and economic uncertainty. Image: Bloomberg