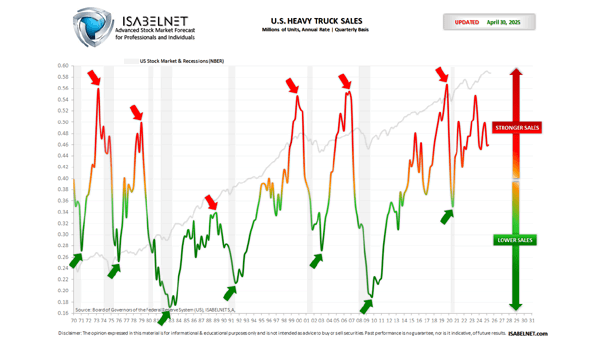

U.S. Heavy Truck Sales and Recessions (Leading Indicator)

U.S. Heavy Truck Sales and Recessions (Leading Indicator) U.S. heavy truck sales fell in May to 450K (annualized). Before recessions, heavy trucks sales tend to peak and then decline, providing insights into the overall health of the U.S. economy as a leading economic indicator. Click the Image to Enlarge