S&P 500 Valuation Multiples

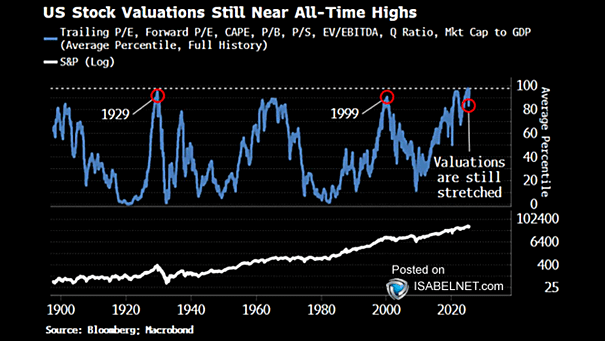

S&P 500 Valuation Multiples Overvaluation in the S&P 500, especially among tech and AI stocks, is a legitimate concern in light of downward revisions to earnings estimates for 2025 and the high degree of index concentration. Image: Real Investment Advice