S&P 500 Valuations

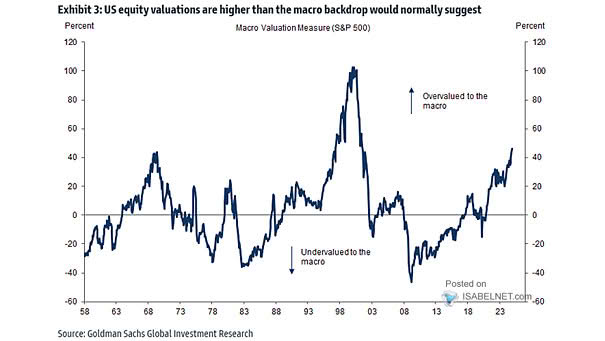

S&P 500 Valuations According to a macro model developed by Goldman Sachs, U.S. equities are suggested to be overvalued by more than 40%, raising concerns among market participants about long-term sustainability and future market corrections. Image: Goldman Sachs Global Investment Research