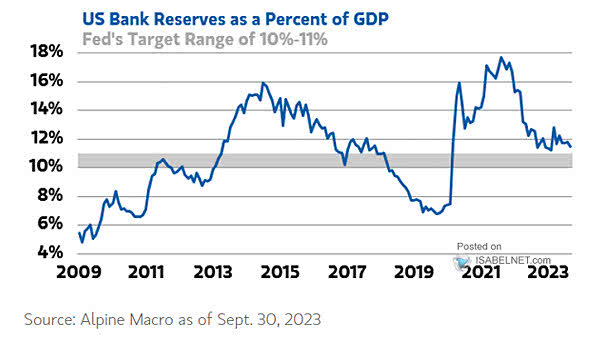

U.S. Bank Reserves as a Percent of GDP

U.S. Bank Reserves as a Percent of GDP As bank reserves relative to GDP gradually return to normal levels, they will no longer contribute to the upward momentum of equity valuation multiples. Image: Morgan Stanley Wealth Management