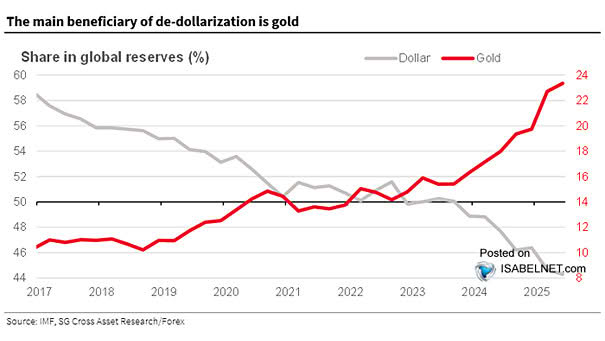

U.S. Dollar vs. Gold – Share in Global Reserves

U.S. Dollar vs. Gold – Share in Global Reserves As countries and central banks seek to reduce their reliance on the U.S. dollar for reserves and international trade, gold has emerged as the preferred alternative asset. Image: Societe Generale Cross Asset Research