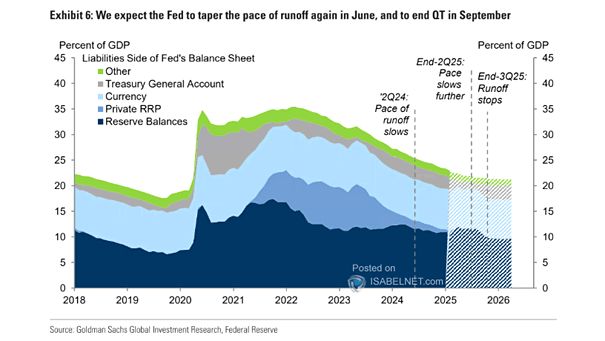

Fed Balance Sheet

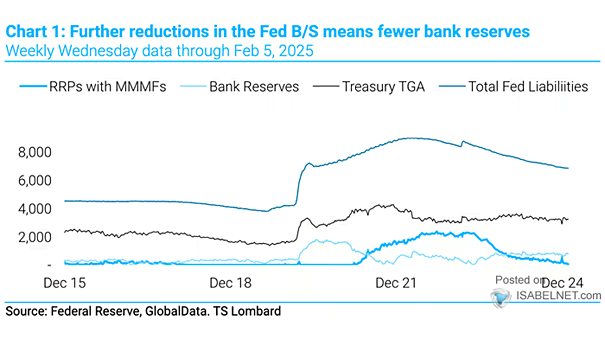

Fed Balance Sheet Goldman Sachs predicts the Fed will slow its balance sheet reduction in June 2025 and end quantitative tightening by September, which could influence market liquidity and interest rates. Image: Goldman Sachs Global Investment Research