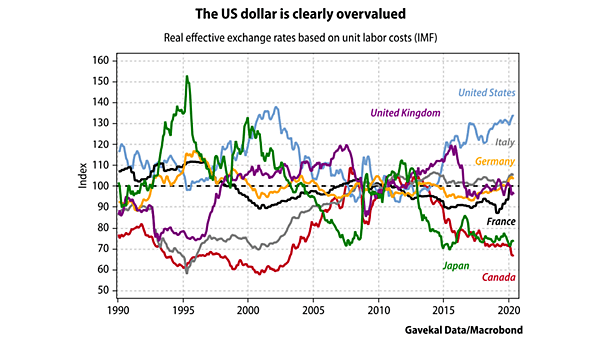

Trade Weighted Dollar vs. U.S. Inflation Surprises

Trade Weighted Dollar vs. U.S. Inflation Surprises Since February 2025, the U.S. dollar has closely tracked inflation surprises, as both headline and core inflation came in lower than expected, reflecting Fed policy expectations and concerns about the U.S. economic outlook. Image: Societe Generale Cross Asset Research