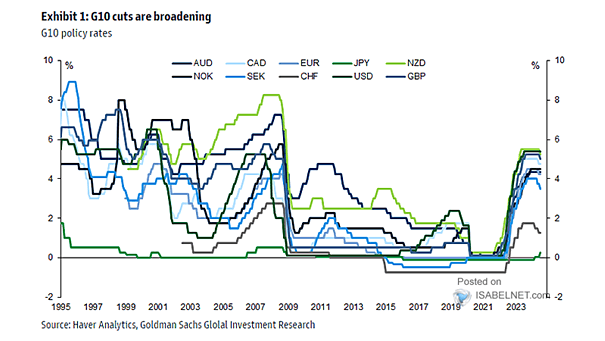

G10 Policy Rates

G10 Policy Rates The majority of G10 central banks are either currently cutting rates or are expected to start soon, reflecting a broader global disinflationary trend and changing economic conditions. Image: Goldman Sachs Global Investment Research